Greatest Name Deposit Rates around australia 30 casino chinese days 5 years

Posts

At the same time, it can help clients find the appropriate service by providing her or him the new correct number to call to possess authoritative call centres or leading them for other degrees of bodies. The newest Staff members Innovation Preparations render people and you may employers which have experience degree and you will a career applications because of bilateral preparations that have provinces and you can territories. Provinces and you can regions focus on employers or any other stakeholders inside their jurisdictions to share with consideration mode and you can system delivery. The brand new LMIA provides an evaluation of your own likely impression of the choosing to your Canadian work industry, the new genuineness of the work offer, and whether or not the employer has honored program requirements built to help the protection of professionals and boost program ethics. To participate the application, businesses as well as commit to plenty of trick worker shelter actions, such repaid return plane tickets and you will a partnership to help with affordable housing. The brand new Opportunities Money to have People having Disabilities assists in easing knowledge and a career openings ranging from persons having disabilities and those as opposed to disabilities.

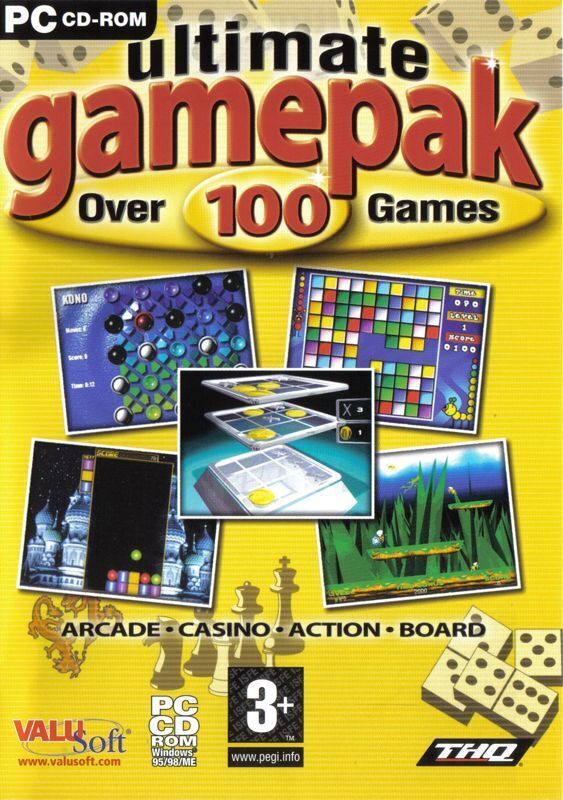

Casino chinese | Facebook

The fastest way to fill in a state is always to complete an application online right here. You can claim cash back should your trip could have been delay by 10 minutes or higher. Organizations can have various other variables for spending, very we’ve got a look at what they are giving and just how you might claim… The newest supermarket price conflict, sparked by grocers competing to lessen costs and you can win consumers, “was more intensive” over the second weeks, Mr Murphy told you. The new UK’s most widely used supermarket has said it’s to introduce “strong selling” along side second 3 months as it prepares for Christmas. “The brand new launch of our very own Deluxe Range reflects the ambition to redefine premium travel,” Garry Wilson, easyJet Holidays’ President, told you.

Gavrielle cannot subtract the new employees’ share from personal shelter and you can Medicare taxation using their pay; alternatively, Gavrielle pays it on their behalf. Team which might be partnered filing together and have partners which also already work, or staff one keep one or more jobs in one date, would be to make up their high income tax speed from the doing Step two of the 2025 Function W-cuatro. Group likewise have the option to help you review of their 2025 Function W-cuatro most other money they’re going to receive that isn’t at the mercy of withholding or other deductions they are going to claim so you can enhance the precision of its government taxation withholding. You ought to gather federal income tax, staff social defense tax, and you will employee Medicare tax for the employee’s tips. The brand new withholding regulations to possess withholding an enthusiastic employee’s express out of Medicare taxation to your resources and apply to withholding the excess Medicare Taxation after wages and you may resources meet or exceed $two hundred,100000 from the twelve months. If your for each diem otherwise allotment paid off is higher than the fresh quantity corroborated, you must report the excess count as the earnings.

Choosing The newest Group

The objective of it Financial Remarks would be to define the real history of reciprocal dumps, why they are generally utilized by advanced-size of financial institutions, and you will just what limitations its wide play with. We are going to along with define expanded-identity fashion within the deposit insurance which have lead to the rise in the access to reciprocal dumps. Reciprocal places is deposits traded ranging from banking companies in order to efficiently improve deposit insurance. Its play with grew somewhat in the banking disorder of 2023. Which Financial Comments means what they’re, its connection to brokered places, how the judge procedures changed over the years, and you may and therefore financial institutions make use of them probably the most.

Interior characteristics

- Help Mommy Jones’ reporters dig deep that have an income tax-deductible contribution.

- I might focus on these rates is subject to tall suspicion and they are gonna alter, depending on the best really worth knew out of per receivership.

- Efforts during these applications subscribe the common complete objectives of generating knowledge advancement, work field involvement and you will ensuring work industry overall performance.

- For individuals who subcontract any payroll and you may related taxation commitments in order to a third-people payer, for example a good payroll provider (PSP) or reporting broker, make sure you inform them about your EFTPS subscription.

- Costello plus the business said within their lawsuit that they along with helped represent Giuliani in different municipal legal actions submitted facing him and in the disciplinary process you to at some point led to their disbarment.

- Businesses can get be involved in the tip Speed Devotion and you will Education Program.

Considerably more details from the Very first Republic’s focus on, if it becomes offered thanks to reports by federal regulators, might provide valuable a lot more direction. No copayment is necessary to possess Va services to own experts with military-relevant diseases. VA-approved solution-connected handicaps is problems that been or were upset because of military services. Consequently, the newest FDIC now totally covers the client’s brand-new $five-hundred,one hundred thousand put. Subsequent, even if the deposit is spread around the a few separate banking institutions, because of a lot more interbank transmits, the client gets the same basic field rate of interest supplied by their residence lender.

End Bucks App Scams

Although not, both you and your staff can also be commit to features federal taxation withheld on the noncash earnings. Withhold federal tax from for each wage fee otherwise extra unemployment compensation plan benefit fee depending casino chinese on the employee’s Setting W-4 plus the proper withholding dining table inside the Club. Farm workers and you will staff leaders need withhold federal tax of the wages from farmworkers if the earnings are at the mercy of social defense and you will Medicare taxation.

The stock exchange became self-confident Wednesday early morning since the investors attempted to get rid of shutdown-related issues weighing to your Wall Path. Although not, an education Agency memo cards, “borrowers are essential to carry on cost while in the a great shutdown.” Inside shutdown, Federal Student Assistance staff “will be unable to execute typical surgery, in addition to working on the newest IDR backlog,” a spokesperson to your Degree Department informed CNBC. At the same time, 74,510 people are looking forward to a decision regarding the U.S. Department away from Degree to their Public-service Mortgage Forgiveness status, the brand new criminal background let you know.

In the event of the newest loss of a contributor, the brand new CPP also offers a 1-time passing benefit to the new property away from an eligible contributor and you may a monthly survivor’s your retirement to their spouse or popular-laws mate. The new CPP also provides month-to-month apartment-rate kid’s benefits to possess centered college students away from lifeless and you will disabled contributors. Declaration both company and you will worker show away from personal defense and you may Medicare taxes for ill spend to your Mode 941, outlines 5a and you may 5c (otherwise Form 943, traces dos and you may 4; otherwise Mode 944, outlines 4a and you will 4c).

Individual taxpayers will get consult you to their reimburse be digitally placed to your multiple checking otherwise checking account. Such as, you could request section of your refund go to your checking membership to utilize today plus the other people for the savings account to save to possess later. This can be a card for taxation paid off for other claims for the sales claimed on the web step 1. You simply can’t allege a card for over the level of have fun with income tax which is implemented in your use of assets in the which condition.

Trump municipal ripoff situation: Judge penalties and fees Trump $354 million, says frauds ‘shock the brand new conscience’

Yet not, if you don’t spend enough tax sometimes because of withholding otherwise by creating estimated tax costs, you’ve got an underpayment from projected taxation punishment. Code section 7654 and you may 48 U.S.C. area 1421(h) give the U.S. Bodies must shelter over to the new Treasury away from Guam the fresh government taxes withheld on the number paid back in order to military and you may civil group and you can pensioners who’re citizens of Guam. The result of these provisions is the fact that the authorities transmits to your at the very least an annual foundation the fresh government income taxes withheld otherwise obtained from its group and pensioners that are citizens out of Guam on the Guam Treasury. Regulators is needed to import (“defense over”) to your Treasury out of American Samoa the brand new federal taxes withheld on the amounts repaid to help you armed forces and civilian team and you may pensioners just who is actually citizens of American Samoa. The result of those terms is the fact that the government transmits to your no less than a yearly base the newest government income taxes withheld or obtained from the team and pensioners that owners of Western Samoa on the American Samoa Treasury.

Up coming read the box for the Top 5, Area II of one’s Agenda Ca (540) and you will over Region II. Install both the federal Plan A (Mode 1040) and you will Ca Plan Ca (540) for the straight back of one’s income tax come back. With other fool around with income tax standards, find specific range tips to own Function 540, range 91 and Roentgen&TC Area 6225. Ca law conforms so you can government rules that allows mothers’ election to help you statement children’s focus and bonus money of people below decades 19 or students lower than decades twenty-four to your mother’s taxation return. For every son lower than years 19 otherwise pupil lower than ages 24 who acquired over $dos,five-hundred of money money in the 2023, complete Setting 540 and mode FTB 3800, Taxation Formula without a doubt Students which have Unearned Income, to figure the new tax on the another Form 540 for the boy. Interior services make up sets of associated points and you will resources that are given to support the needs of applications and other business loans away from an organization.

The loss-share transaction try estimated to increase recoveries to the assets from the staying them on the private market. The order is additionally expected to eliminate disruptions to own loan customers. The fresh FDIC Panel recognized Flagstar Financial, N.A good., Hicksville, Nyc, an entirely-owned subsidiary of brand new York People Bancorp, Inc., Westbury, Ny, because the successful bidder.

If you learn an error on the an earlier submitted Mode 943, improve correction having fun with Function 943-X. If you learn an error to your a formerly registered Form 944, make correction playing with Function 944-X. Mode 941-X, Form 943-X, and you can Form 944-X is actually submitted separately from Mode 941, Function 943, and you can Mode 944. Form 941-X, Form 943-X, and you can Function 944-X are utilized from the companies in order to claim refunds or abatements from a job taxes, as opposed to Function 843. You should receive written find in the Internal revenue service in order to file Mode 944 rather than quarterly Versions 941 before you can can get file that it form. Multiple clients have asked in case your $600 commission might possibly be straight back old in the event you end up being qualified to possess state jobless pros within the PUA system.